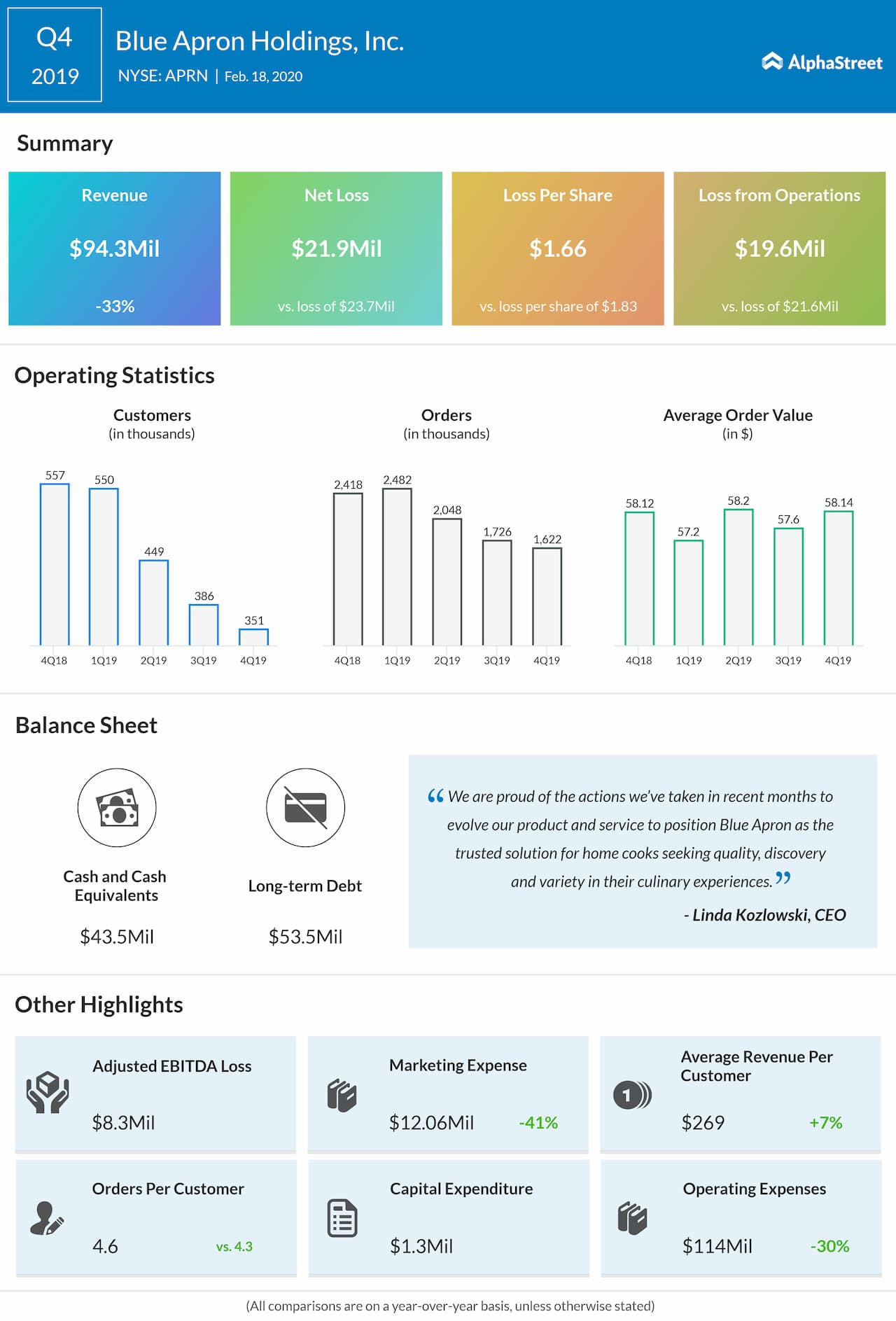

Record high Average Order Value of $73.15 in 4Q22, an increase of 14.7% year-over-year and 3.3% sequentially, due to a price increase introduced in FY22, expanded product offerings and upsell Net revenue of approximately $107 million in 4Q22, flat to the prior year period and down 3% sequentially, impacted by a seasonal decrease in volume Sees Significant Reduction in Cash Burn as of End of February 2023īlue Apron (NYSE: APRN) today announced financial results for the fourth quarter (4Q22) and full year (FY22) ended December 31, 2022. Sanberg’s affiliate to meet its obligations,” but now has the right to foreclose on the pledged collateral.Announces Amendment to Accelerate Debt Pay Down, Reduces Liquidity Covenant

/cloudfront-us-east-1.images.arcpublishing.com/dmn/VOCBNMGYNNE5ZJYUTUWXRI5MPY.jpg)

The company said it “continues to assess the ability of Mr. The company entered into an agreement earlier this year with shareholder Joseph Sanberg to get funding through a private placement but reiterated Thursday that it hasn’t received the promised investment. It reported less than half that total in its most recent quarter. Blue Apron’s quarterly revenue peaked at $238 million in 2017. The precipitous decline in value underscores the fading appeal of the once-buzzy business model of delivering ingredients to busy consumers so they can prepare their own meals at home. The shares are now trading below $1, putting them at risk for a potential delisting. The company’s market capitalization stands at about $30 million - a far cry from its peak of almost $1.9 billion after its 2017 initial public offering. The shares rose as much as 14% before paring gains. Blue Apron expects to stay compliant through at least the first quarter of 2023 and remains in talks with its financial advisers to evaluate financing and other alternatives. The savings will help the company strengthen its balance sheet to maintain compliance with its minimum liquidity covenant of $25 million. The company had 1,694 full-time workers as of June 30.

Blue Apron said it will incur about $1.2 million in employee-related expenses from the job cuts.

The company expects to slash spending by as much as $50 million in 2023 and “create a more nimble, focused organization and to better align internal resources with strategic priorities,” according to a statement Thursday.

0 kommentar(er)

0 kommentar(er)